Although a wide variety of classifications exists, generally, MFI development stages include start-up, growth and maturity phases.

The value of the life cycle is that it provides a framework to understand the stages through which MFIs pass as they progress and to assess their challenges, opportunities and needs.

Although for the MFI industry a similar analogy can be applied, this brief focuses on individual MFIs.

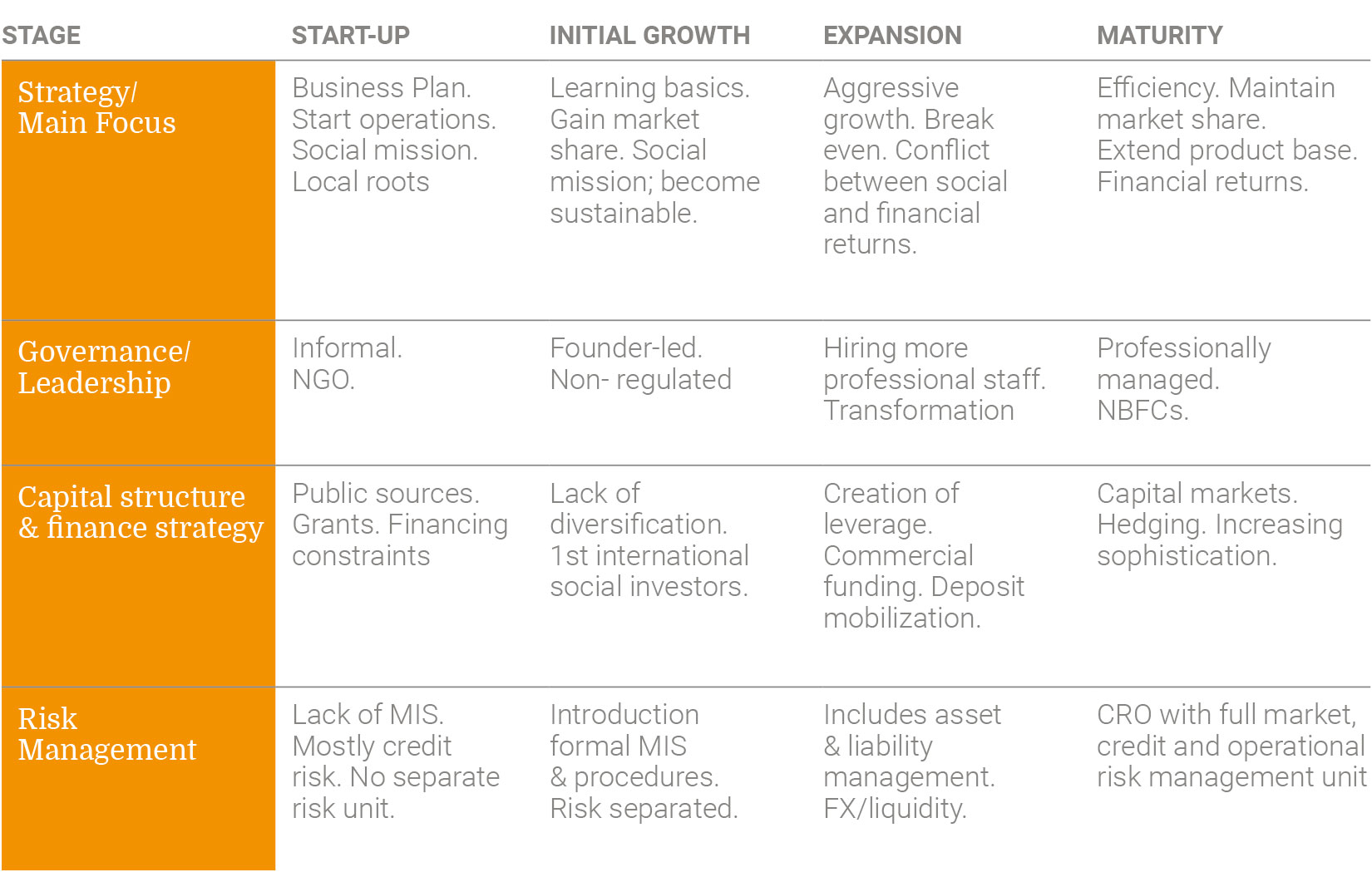

Early stages

MFIs typically originate from member based organizations (NGOs) or increasingly by the private sector. They generally operate in a local setting and are informally led by a key person. With local roots, they typically have a strong social mission (in terms of fighting poverty) and face little competition.

Financial resources are restricted to typical funding by friends, family, sweat equity or donors. Early risk capital is seldom owned by profit maximizing investors or institutions.

Risk management is in its infant stages and predominantly geared towards credit risk. MFIs build internal controls and are typically governed by a Board of ‘representatives’ of the founding members.

MFIs are operationally becoming break even but need grant support for building.

Expansion

The strategy of the MFI moves towards building outreach and increasing professionalization. Typically, MFIs transform, and legal structures change to cater for growth. MFI management increasingly struggles to maintain the balance between social and financial returns. Mostly a driven, vibrant corporate culture, but decreasing touch to community.

Business wise the MFI grows by opening new branches, offering a wider range of services and face increasing competition. MFIs operate near or better than break even on a fully loaded P&L. Investment rather than cost.

From a funding perspective, the investor base widens by the mobilization of savings /deposits, increasing leverage, mix of hard and local currency debt and more commercially oriented investors.

Risk management becomes more professional and includes asset and liability management (including liquidity and foreign exchange risk as well as maturity mismatches). Generally, under more regulatory oversight. Improving transparency and legitimacy. MFIs become rated.

Maturity

The strategy is focused on efficiency and maintaining market share. Competition is strong. Cost cutting rather than investment. Financial returns become more dominant and the MFI drifts from its original social mission. Usually fully profitable.

Formal organizational structure, professional staff runs the MFI. Internal audit is well organized and competent. Professional boards are appointed. Liability management includes the tapping capital markets via an IPO or structured products. MFI is playing regional consolidation/acquisition game.

Conclusion

Although, the emergence along the MFI life cycle seems ‘inevitable’, there are growing concerns that particularly mature MFIs are drifting from the origins i.e. fighting poverty. Although the emergence of this class of commercial financial institutions is not bad in itself, it cannot replace socially driven yet sustainable MFIs that stay close to their original social mission and make different strategic and financial choices as they progress along the MFI life cycle.